As we have noted, crowdfunding and private investing is becoming a great mainstream, investment opportunity. While non-accredited investors have only been able to invest in private in companies for a little over five years, the rapid acceleration of crowdfunding apps have given retail investors access to more alternative investments than ever before, as we detailed in our Wefunder review. One of the newest alternative investment apps on the market is Yieldstreet. Launched in 2015, Yieldstreet has evolved to provide an array of investment alternatives. Today we take a close look at Yieldstreet with Wealthplicity’s Yieldstreet review.

Yieldstreet was launched in 2015 as a way for investors to invest in legal finance and real estate asset classes. Legal finance or “litigation funding” is an incredibly unique, alternative investment that invests money in pre-settlement lawsuits. Litigation funding is the practice of lending money to a plaintiff or law firm who may have a strong case but does not have the funds to match the financial power of the opponent. The funding is a non-recourse loan and plaintiffs do not have to repay the loan if they don’t win their settlement.

Since then, Yieldstreet has opened more alternative investment opportunities such as Marine Finance, which allows investors to invest in Vessel Acquisition, Vessel Construction, and Vessel Deconstruction, as well as opportunities in wine, art, and even motorcycle loans.

Though Yieldstreet offers an array of unique alternative investments, crowdfunding real estate is a primary offering. While apps like Fundrise take a value-based, equity approach to investing in real estate, as we talked about in our Fundrise review, Yieldstreet is primarily a debt-based approach to real estate investing.

When you speak of alternative investing, Yieldstreet truly is a pioneer in the space. They were even the first to launch an alternative investment app.

The primary return for investors is in the form of income, where investors earn interest payments or principal investment over the life of their loans.

Yieldstreet can be a great app for investors seeking to diversify their portfolio through income generating assets. However, it does have several drawbacks such as the limited amount of investment deals for non-accredited investors. We detail all the pros and cons below in our Yieldstreet review.

Wealthplicity’s Yieldstreet Investment Review looks at 5 points of critical criteria to score its overall performance.

Yieldstreet is a crowdfunding investment platform geared toward accredited investors seeking to diversify their investments through income-generating, alternative investors such as real estate loans, litigation funding, marine finance, wine, and art

best for:

accredited investors, alternative investors, income investors

Get Yieldstreet Pros & ConsPros:

Cons:

Yieldstreet is best for investors seeking to diversify their portfolio outside of the stock market through income generating assets.

Yieldstreet has offerings for both accredited and non-accredited investors, but accredited investors have a much greater deal variety and offerings available to them. Non-accredited investors seeking to diversify their portfolio may have better opportunities with Fundrise or Wefunder.

Yieldstreet would not be a great app for new investors. While there are a lot of good, educational articles that easily defines their unique industries and offerings, the very nature of these alternative investments can take years to understand. Investing in wine, motorcycle loans, and vessel deconstruction is probably not the starter portfolio an emerging investor class would be looking for.

Yieldstreet fees can be a little confusing to understand. Their structure is a little vague and do not provide specific examples on how fees are included.

The straightforward fee structure:

Yieldstreet collects an average of 1-2% management fees on all offerings from investors annually.

The not-son straightforward fee structure:

On top of this there is a “flat annual fund expense” that investors are responsible for per investment. These are paid form the initial interest distributions from the investment. These vary slightly depending on the legal structure of the offering (SPV or BPDN) structure.

The majority of Yieldstreet’s investments are primarily geared toward accredited investors. Being an accredited investor allows you to invest in the single asset class, meaning you have a much greater deal variety and the ability to perform a deep due diligence on your potential investment.

If you are a non-accredited investor, you can still invest but it is through Yieldstreet’s Prism fund. Yieldstreet’s Prism fund allows non-accredited investors to build a fixed-income portfolio spread out across multiple asset classes. Currently the fund has six asset classes: Art, Commercial, Consumer, Legal finance, and real estate.

The minimum investment for the Yieldstreet Prism fund is $1,000.

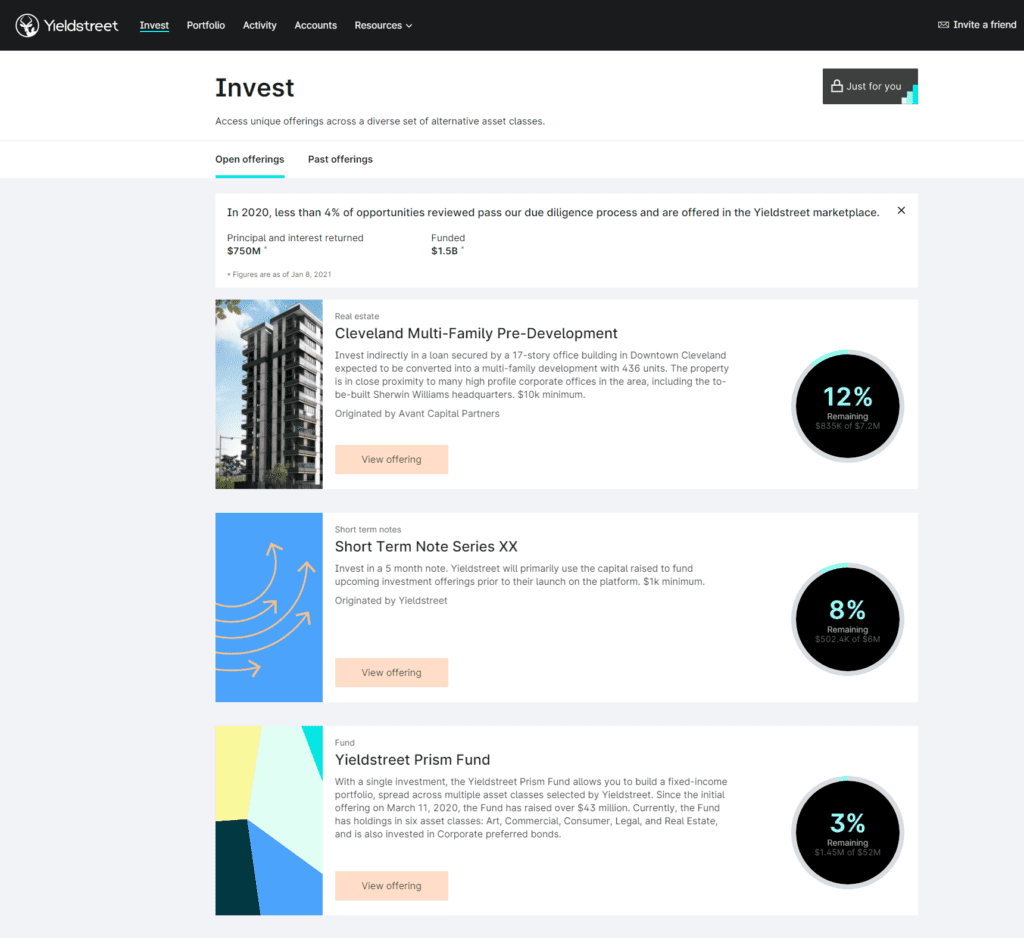

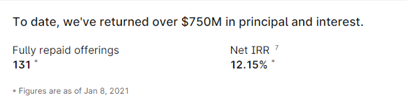

As of February, 2021, there are six active deals on Yieldstreet. There did not seem to be a wide variety or number of total offerings. There have been a total of 131 fully repaid offerings over the course of Yieldstreet’s existence. So, even if you are an accredited investor, the limited amount of deals available may not be attractive.

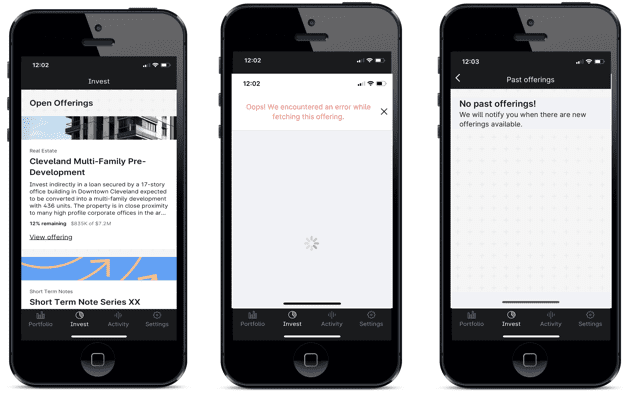

Yieldstreet’s web interface is a lot better than its app. Its app is not terrible, but it lacks depth and kept timing out on me when I was trying to access the offering details.

There is a general lack of insight and research per offering. When I compare it to an app like Fundrise, it lacks the sophistication and the single-click information structure that would allow you to navigate between your portfolio, offerings, articles, and other information.

In reality, I can’t really access more than 8 or 9 pages on the app. This usability ranks poor for Wealthplicity and will need to be updated to reflect a modern, user experience.

Finding critical information proved to be a little challenging. They did have a comprehensive FAQ section but as we mentioned in the fee section, the fee structure would be better illustrated with some real-life examples.

In addition, we did find information on past offerings and results but only for “fully repaid offerings.” I had a hard time finding any information on default rates of past offerings or what the total return would be across all offerings.

In Summary:

Yieldstreet has some unique offerings into alternative investments. Those accredited investors seeking to diversify their income portfolio may find litigation finance, marine finance, art and wine opportunities appealing. However, Yieldstreet needs to work on the overall amount of offerings available, the due diligence and information provided around offerings, overall transparency and the usability with their platform – primarily their app.