The past several years has seen an explosive growth in new technology and innovation. With this growth, comes new opportunities for investors to create wealth outside of the stock market. The rise of Crowdfunding platforms has given retail investors opportunities to realize returns 2x and 3x that of the stock market. And among the 5 main types of crowdfunding; donation, rewards-based, debt-based, profit sharing and equity, equity-based crowdfunding continues to see the highest growth rate and popularity. So, let’s take a look at the Top Equity Crowdfunding Platforms for 2021 and how they can make you a serious return on your investments.

We recently touched on the diverse options you have with real estate crowdfunding and how investors can profit from a combination of investing in debt and equity. In fact, based on a recent study, a blended real estate investment of debt and equity could net you anywhere between a 11-15% return. This could nearly be triple your return of a blended stock and bond investment. As the real estate market continues to recover, real estate crowdfunding is something you want to consider.

However, by exploring other equity-based crowdfunding platforms, you will quickly realize that there is an abundant amount of private investing opportunities that could explode your portfolio. The facts show that the global crowdfunding market size was $84 billion in 2018 and is expected to reach $114 billion by 2021 and out of all crowdfunding categories, equity crowdfunding is expected to grow the fastest at a rate of nearly 40% Compound Annual Growth Rate.

There is a reason so much capital is being poured into the private market. This is because when it comes to the public vs. private market, the private market is winning by more than 2-1. The annualized rate of return for the public market is 10.2% and the private market nets an annualized return of 26%. To put this in dollars and cents, a 26% rate of return on a $20,000 portfolio would net you more than $3.5 million dollars.

But before diving in heads first into the private marketing, you should know that there is still nearly a 40% failure rate on startups. However, you can greatly increase your odds of investing in a successful startup if you do your due diligence. This due diligence starts with the crowdfunding platform itself. We have identified 5 main criteria that an investor needs to know before considering selecting an equity crowdfunding site.

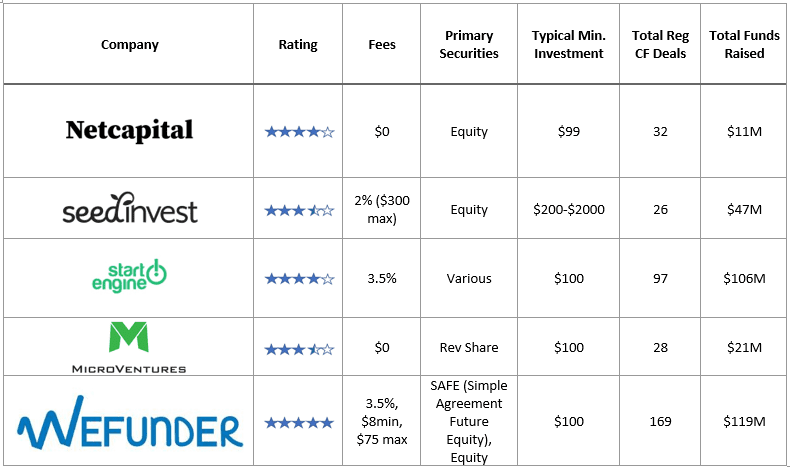

With these criteria in mind, we identified 5 of the top equity crowdfunding sites for 2021. As always, the deals vary, and you should only invest an amount you would feel comfortable losing.

Another great criterion to look out is transparency of results. For many of these deals, it’s too early to judge performance but Wefunder has a great results page and the performance looks outstanding. If these results are any indication of private market performance, then finding a top equity crowdfunding platform should top the list of your investing priorities for 2021.