When it comes to self-directed retirement plans like a 401(k) or IRAs, options have been limited. Typically, investors can pick their preferred mutual fund within their brokerage but even those are limited. Now, a new investment app has created one of the first, truly, self-directed retirement plan on the market. Rocket Dollar now allows investors to manage their 401(k) or IRA in any asset class allowed by the IRS. This includes all stocks, bonds, real estate, cryptocurrency, startups, and more. So, is Rocket Dollar self-directed retirement plans worth the investment? We take a close look in our 2021 Rocket Dollar review.

Rocket Dollar was founded in 2018, so a lot like most investment apps, it’s still just starting out. However, Rocket Dollar is quickly becoming recognized as one of the most popular investing apps for those investors who seek greater flexibility in self-management.

We have talked extensively about alternative investing here at Wealthplicity but we have yet to come across an app who brings together the traditionally, static method of retirement investing through 401(k)s and IRA’s with the alterative investing approach.

As you’ll see below in our Rocket Dollar Review, it has one of the most diverse sets of investable assets in the space, and is one of the only investment apps that allows you to use your retirement funds as your primary investment vehicle.

Rocket Dollar is one of the first investment apps to marry traditional retirement plans like 401(k) and the world of alternative investing. Rocket Dollar is an excellent option for seasoned investors who want to self-direct their retirement plan and include alternative investments such as cryptos, real estate, or even start-ups.

best for:

self-directed investors, alternative investors

Get Rocket Dollar Pros & ConsPros:

Cons:

At Wealthplicity, we rate and rank our investment apps based upon the most important criteria to the customer. We look to keep this criterion consistent across all reviews but may adjust upon industry or offerings.

Rocket Dollar is not for beginners. It isn’t for new investors who have recently opened their first 401(k) and are quickly looking to accelerate their earnings. The typical audience for Rocket Dollar are seasoned investors who have a Net Worth of $500k+ and earn a household income of $100k+.

The world of alternative investing is particularly volatile, especially as you get into startup investing and crypto currencies. Alternative investing is still very new with most investable assets coming on the market in the past few years. So, for those newer investors who are interested in expanding their interests and diversifying their portfolio, check out some of our other reviews that would allow you to try new approaches without having to invest your retirement portfolio.

These are all great investment options, now let’s get into our full Rocket Dollar review.

Rocket Dollar’s fees are straight forward and easy to understand. For their Core Plan, there is an initial one-time $360 dollar setup fee and $15 per month ongoing fee.

For their Gold plan, there is a $600 one-time setup fee and a $30 per month ongoing fee.

Rocket Dollar’s offerings and features is where it truly separates itself from other investing apps. First, let’s review the different type of assets you can invest in. Now, this is just an example as the list goes and on:

Rocket Dollar also offers two plans, Core and Gold.

| Core | Gold |

| No Minimum Opening Deposit Required | All Core features |

| An LLC to hold investments (IRA Only) | Expedited service and transfers |

| Online document storage | Four free wire transfer per year |

| Investment dashboard to track investments | Physical Rocket Dollar Gold Debit Card |

| Email support | Custom-named LLC (IRA only) |

| No cost cash transfers from current custodian | Roth IRA conversion assistance & tax filing for 1099-R |

| Fair Market Value reporting on Form 5498 (IRA only) | Tax Filing for Solo 401(k) Form 5500 |

You do not need to be an accredited investor to use Rocket Dollar but you will not have access to the full investable suite of assets. Investor requirements vary by investment not Rocket Dollar. For instance, non-accredited investors can still invest in cryptocurrency, rental real estate and equity crowdfunding.

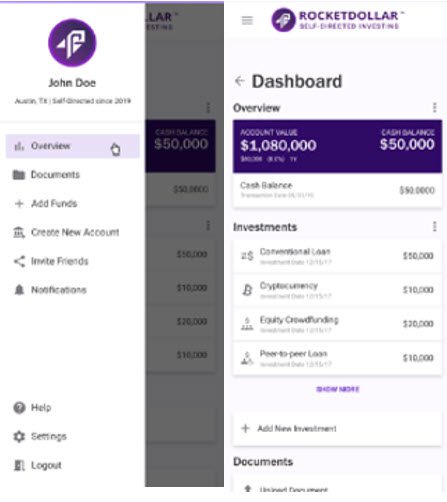

Rocket Dollar, like most new investment brokers is best managed on its app. The setup is straight forward and does not deviate from other investment brokerages in the information that is required.

They have a great User Experience within the app with intuitive and clean navigation which makes it easy to navigate the variety of investments.

Rocket Dollar has a nice amount of information on their website with a lot of different learning materials such as, webinars, white papers, guides, and courses. The subject material ranges from tax management to how to invest in startups.

The overall returns and performance of Rocket Dollar comes down to the individual investor since this fully self-directed. Unlike Robo-Advisors like Betterment and Acorns the performance of a portfolio solely relies on the investor.

When you are talking self-directed IRA’s or 401(k)’s, Rocket Dollar needs to be in the conversation. It is an excellent app that allows the investor a wide range of investment options and lets them use their retirement portfolio to drive it.

If you are a seasoned investor and are looking to expand your retirement options, Rocket Dollar should be a strong consideration.