If you are new to investing, taking the time to learn the fundamentals is crucial to your long-term success. The same can be said if you are new to trading options. Learning to trade options can be an excellent way to accelerate profits in your portfolio but can lead to catastrophe if you are not properly prepared. Understanding some of the top option strategies for beginners, those that are lowest in risk, is a great place to start if you want to trade options. We have recently written about low-risk option strategies like the Long Call and the Long Put. Another great option strategy for beginners is the Married Put.

A Married Put is an options trading strategy similar to a long put where an investor owns a stock they are bullish on and at the same time purchase a put option on the same stock in order to hedge any near-term depreciation in the stock price.

An investor may use a married put on the underlying security they own if they feel that there may be some short-term, negative impact on the stock’s price. For instance, they may use this strategy heading into an earnings call where they feel that certain factors will cause the stock’s price to decline in the short term, but will eventually rebound and continue to grow over a longer period.

Many options strategies are used as rapid profit makers. However, the Married Put acts as insurance against any depreciation of a stock price.

This is a great option for beginners because the risk of loss is limited to the premium paid, but the profit potential is theoretically unlimited since the investor already owns the stock and there is no limit to a stock price.

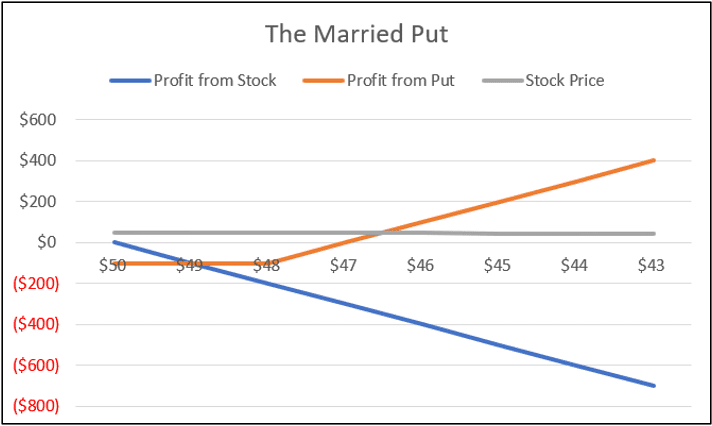

The Married Put works best when the value of the underlying stock falls and the value of the put option increases covering the depreciation of the stock dollar for dollar.

Let’s take a look at the married put strategy in a real-life situation. In this scenario, you are the investor, and you are going to use a married put to hedge any short-term price depreciation of a stock you plan on holding for a long time.

The stock you own is Enphase Enegry (ENPH). Enphase Energy is a company that produces microinverter systems for the solar energy industry. Microinverters are responsible for converting direct current energy that is produced by solar panels into usable alternating current electricity used by your home.

Green stocks have been on a tear lately and are poised to continue growth, so you decide to purchase Enphase Energy stock and plan on holding in for a long time.

But, uh-oh! Lately, you have been hearing a lot of news on the issue of Solar energy’s land Use. Solar energy uses a lot of real estate for their solar farms compared to fossil fuels which has been hampering the global expansion of solar energy. So much so, that major cities like New York are delaying their conversion to renewable energy until they come up with a more efficient solution.

Enphase earnings is next week and you feel that this news is going to have a negative effect on Enphase Energy’s revenue and stock price.

So, you decided to place a Married Put option on ahead of earnings incase Enphase’s stock price is harmed in the short term.

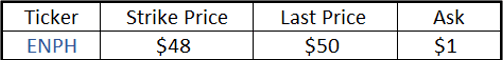

For simple math, let’ say that Enphase is trading at $50 when you bought 100 shares for $5,000. The put contract you bought was $100, which is a premium of $1*100 shares which is the total number of shares represented by one option contract.

Sure enough, during earnings, Enphase says that their short-term revenue will be impacted by land use issues, but they are working with the solar companies to create smaller, more efficient panels so the future still looks bright.

In the short term, Enphase’s stock drops from $50 to $43 before it begins to rebound. If you just held the stock without purchasing a married put, you would have realized a short-term loss of -$700. However, because you used the married put strategy, you were able to mitigate your loss by making a profit of $400 on the option.

Here is how that would look:

In Summary:

Trading options can be risky. Understanding how to trade options can help mitigate that risk. Using options strategies like the Married Put can create a greater safety net for those seeking to hedge their risk.

As always, do your due diligence, speak to a financial advisor if you are unsure how to get started, and happy investing.